Essays Contents

Corporate Charters

February 2, 2023

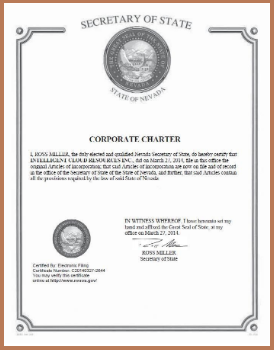

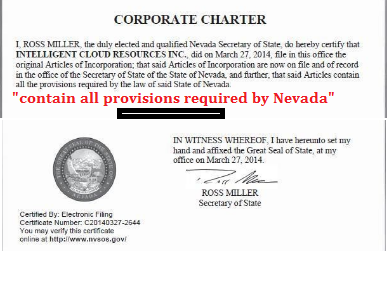

sample corporate charter from Nevada

and the application for incorporation

General information on the history of Corporate Charters

Many years ago, I heard a speech where a person was calling for

the revocation of a company's "corporate charter"...

meaning... move to deny that company the right to do business...

on the grounds that "it" had betrayed the public trust.

At the time, I assumed that corporations were required

to apply for such a charter... or a "permission"...

from every state in which it intended to do business.

It just seemed to me that... the whole point of this process

was to ensure that a company would abide by the law

and would do business in a way that protected the public.

Thus... if its practices were ever found to be illegal or unethical...

the state had the immediate power to remove that "permit."

I'm surprised that there aren't more state laws on this...

or if there are... why some law-breaking corporations are still

allowed to continue to do business with the people in a state.

One state's laws cannot be forced on another state through

the mechanisms of corporate business practices, with the charter

solely in one permissably liberal state.

Investors are vulnerable in today's markets. It appears that

Wall Street has become nothing more than a glorified casino.

I have no idea how any corporation can invest in new products

or infrastructure in such a frenzied climate. And millions of

investors do not do the hard work of research about their investment

money.

Does such and such company violate international laws?

Have they been sued because of their practices?

How does it behave in foreign countries as an "American" company?

Who is the chairman and how much is he paid?

Who sits on the board? are these political people?

How much does the board get paid for their services?

Are the products quality products? or junk.

Investing money is about more than... the quickest profits.

In a real way... it is about civilization... human creativity...

relationships with people in other countries... with other cultures...

and business really is... relationships between human beings.

The following are some notes on the subject... and a bit of history.

emphasis and paragraph structure are sometimes edited

law.cornell. corporate charter

A corporate charter is a flexible document that an incorporator is required to prepare and file with the Secretary of State in the state of incorporation. The corporate charter must name the original incorporations, the corporation’s name and its business, and its original capital structure (for instance, the number and classes of shares).

Corporate charters also include information about the corporation’s purpose, any voting rights attached to these shares, and sometimes the size of the Board of Directors along with their terms and the process for removing a member of the Board of Directors.

wikipedia: Articles of Association (corporation)

Archived wikipedia page

In corporate governance, a company's articles of association (AoA, called articles of incorporation in some jurisdictions) is a document which, along with the memorandum of association (in cases where it exists) form the company's constitution, and defines the responsibilities of the directors, the kind of business to be undertaken, and the means by which the shareholders exert control over the board of directors.

Articles of association are very critical documents to corporate operations, as they may regulate both internal and external affairs.

Articles of incorporation, also referred to as the certificate of incorporation or the corporate charter, is a document or charter that establishes the existence of a corporation in the United States and Canada. They generally are filed with the Secretary of State in the U.S. State where the company is incorporated, or other company registrar. An equivalent term for limited liability companies (LLCs) in the United States is articles of organization.

History of corporations in the United States

After fighting the American Revolution with Great Britain, the founders of the United States had a healthy fear of corporations after being exploited for years by those in England. As a result, they limited the role of corporations by only granting select corporate charters, mainly to those that were beneficial to society as a whole.

For the better part of the first one hundred years of United States history, the power of corporations was severely limited as owners could not own any stock or property, make financial donations to a political party, and legislators could dissolve a corporation at any time relatively easily. Corporations did not have the same corporate veil of protection that are enjoyed today.

The shift towards corporations gaining more power and control happened as the United States progressed towards industrialization. The American Civil War wildly enriched corporations and with this new wealth came bribes to legislators and courts that allowed for increased liability protection and other corporate protections.

The 1886 Supreme Court case Santa Clara County v. Southern Pacific Railroad set the important legal precedent that corporations were “natural people” and as a result were protected under the 14th Amendment. In the century and a half to follow, corporations have gained more control and hardly resemble what the founders of the country had intended.

britannica... "corporation" page

Archive... britannica "corporation" page

Corporation

corporation, specific legal form of organization of persons and material resources, chartered by the state, for the purpose of conducting business.

As contrasted with the other two major forms of business ownership,

the sole proprietorship... and the partnership,

the corporation is distinguished by a number of characteristics that make it a more-flexible instrument for large-scale economic activity, particularly for the purpose of raising large sums of capital for investment.

Chief among these features are:

(1) limited liability, meaning that capital suppliers are not subject to losses greater than the amount of their investment;

(2) transferability of shares, whereby voting and other rights in the enterprise may be transferred readily from one investor to another without reconstituting the organization under law;

(3) juridical personality, meaning that the corporation itself as a fictive

“person” has legal standing and may thus sue and be sued, may make contracts, and may hold property in a common name; and

(4) indefinite duration, whereby the life of the corporation may extend beyond the participation of any of its incorporators. The owners of the corporation in a legal sense are the shareholders, who purchase with their investment of capital a share in the proceeds of the enterprise and who are nominally entitled to a measure of control over the financial management of the corporation.

The form of the modern business corporation originated in a fusion of the type of commercial association known as the joint-stock company, which was in fact a partnership, and the traditional legal form of the corporation as it had been developed for medieval guilds, municipalities, monasteries, and universities.

Although business corporations were formed in England as early as the 16th century, these enterprises were monopolies chartered by the crown for the pursuit of strict mercantilist policies and were thus closer, in some respects, to the form of the modern public corporation than to that of the private business corporation.

The fusion of the two forms took place incrementally over the first two-thirds of the 19th century in Great Britain, the United States, France, and Germany with the passage of general incorporation laws, which gradually made incorporation a more or less routine matter for business enterprises.

Particularly influential for this development in the United States was the fact that powers of incorporation were largely restricted to the individual states under the Constitution, which led in the late 19th century to competition between the states for liberalization of their respective incorporation laws. Given the freedom of interstate commerce guaranteed under the Constitution, would-be incorporators could choose the state in which they wished to incorporate without compromising their freedom to transact business in any other state.

Strong impetus for this fusion of the two forms arose from, and was intensified by, the spread of new capital-intensive technologies of production and transportation. In particular, the construction of railroads -- a matter of pressing national importance for all industrializing nations in the late 19th century -- required large sums of capital that could be secured only through the corporate form and, in fact, only with many innovations in the development of financial and debt instruments within the corporate form.

Moreover, the railroads made possible, and in some cases made necessary, an enormous expansion of existing industries (notably steel and coal) that the corporate form alone could support. By the final third of the 19th century, the last legal obstacles to the corporate form had been removed, and the ensuing period (c. 1870–1910) saw an unprecedented expansion of industrial production and the concomitant predominance of the corporate form.

However, with these developments came new problems. Large industrial corporations such as the Standard Oil Company and the United States Steel Corporation came to exercise monopolistic powers in their respective economic spheres, often apparently at the cost of the public interest. U.S. President Theodore Roosevelt sought to curb this concentration of corporate power in the early 20th century, urging the enactment of antitrust legislation aimed at preserving competition.

As corporations increased in size and geographic scope, control of the enterprise by its nominal owners, the shareholders, became impossible when the number of shareholders for the largest companies grew to the tens of thousands and as the practice of proxy voting (i.e., the voting of shares of absent stockholders by management in the annual shareholders’ meetings) was legalized and adopted.

Salaried managers came to exercise virtually proprietary discretion over the corporation and its assets, which gave rise to debates that continue today over the nature of ownership and the social responsibility of corporations. (See multinational corporation.) Shareholders have nonetheless attempted to influence the actions of corporations through annual proxy proposals.

The contemporary social, economic, and, in many cases, political importance of business corporations is beyond dispute. The millions of corporations throughout the world dominate the manufacturing, energy, and service-industry sectors of most developed and many developing nations.

Fordham Law School, Journal of Corporate & Financial Law

law.fordham.edu page... history of corporate form

Archive of same web page

Part One: What Exactly is a Corporation?

A corporation is a legally distinct entity that has many of the rights attributed to individuals. These rights include the ability to enter into contracts, take out loans, sue others, be sued, own assets, pay taxes, and so on.

A corporation is formed when individuals exchange consideration (usually in the form of cash) for shares of the corporation, which in turn creates a right to a portion of profits. Generally, the losses incurred by a shareholder of a corporation are limited to the amount invested; this concept is known as limited liability. Limited liability allows individuals to avoid personal liability for a business entity’s losses, thereby allowing risk-averse individuals to assume risks they otherwise would not have undertaken.

Corporations also allow individuals to pool resources to achieve goals that would be unattainable by a person acting in an individual capacity, and can last longer than an individual’s lifetime. The benefits of the corporate form also create opportunities for abuse, which will be discussed below.

Part Two: The Development of the Corporate Form

The roots of the "corporate form" can be traced into antiquity. Below, I will discuss important developments which have shaped the corporations we know today. I will begin with the emergence of limited liability.

Early Notions of Limited Liability:

The corporate form emerged from economic arrangements that mirrored the concept of limited liability offered by modern corporations. One such arrangement was the commenda, a system developed in Eleventh Century Italy, wherein a ‘passive partner’ provided funding for a merchant vessel to be sailed by a ‘managing partner’ who invested no capital.

Upon completion of the voyage, the partners divided up the profits under a predetermined formula. This arrangement allowed the passive partner to limit his or her liability of their investment, while the managing partner assumed the risks associated with the cargo and the voyage. Soon, investors began pooling their funds to diminish the risk of losing their entire fortune on a single voyage. In doing so, the investors realized the benefits of pairing limited liability with diversification.

Development of ‘Joint-Stock’ Companies: In the 1600s, the British Crown began granting monopolies to groups of investors willing to undertake certain ventures. These monopolies took the form of “joint-stock” companies that allowed labor and capital to be aggregated for the purpose of undertaking tasks that would be too large for any one person.

A famous example was that of the East India Company, in which investors pooled capital into a single “joint-stock” company from which profits would be distributed according to capital invested. Only members of the East India Company had the privilege of conducting trade with India.

The East India Company eventually came to form a government over large portions of India and maintain a standing army.

Other notable “joint-stock” companies, such as the Virginia Company, helped expand British control of North America. In fact, the Virginia Company established the General Assembly, which was the first legislature in North America. These examples show that by allowing the aggregation of resources, corporations can be organized to carry out tasks too big for one person, or even one government.

Government-Chartered Corporations in the U.S.:

Considering that America was literally settled by corporations, their early popularity in the U.S. should not be surprising. In Alexander Hamilton’s second Report on Public Credit, he argued for a federally chartered national bank to help provide centralized direction for the financial sector. The bank was established soon thereafter.

In his Report on Manufacturers, Hamilton argued for a comprehensive federally backed plan to expand public works, which was not immediately accepted. In later years, however, the government would embrace its ability to direct industry through the creation of industrial corporations. A famous example of this was the chartering of the Union Pacific Railroad, and other railroad companies, for the purpose of constructing the transcontinental railroad.

Emergence of Truly Private Corporations:

Throughout the 1800s, and particularly in the late 1800s, corporations began to shift away from the strict limitations of their legislature-approved charters. This shift was illustrated in 1896 when New Jersey passed a statute allowing corporations to define the scope of their charters themselves, independent of the government.

Many of the benefits of the corporate form discussed above quickly came to be abused in the late 1800s. For example, John D. Rockefeller’s Standard Oil Company came to control 90-95% of oil refineries in the U.S.. Journalists, such as Ida Tarbell, exposed the nefarious methods used by John D. Rockefeller to push out honest competitors.

Federal Regulation of Privately-Owned Corporations:

The government responded to harmful corporate behavior through the passage of the Sherman Antitrust Act, which sought to limit large corporations’ ability to fix prices and exclude competition. Under the administration of Theodore Roosevelt, the Sherman Act was vigorously enforced through over 40 antitrust suits.

The most famous of these cases, Northern Securities Company v. United States, resulted in a 5-4 decision where the Supreme Court ordered the dissolution of J.P. Morgan’s Northern Securities Trust. Justice Harlan, writing for the Court, stated that “the court may make any order necessary to bring about the dissolution or suppression of an illegal combination that restrains interstate commerce.”

For the Benefit of Shareholders:

Traditionally, directors of corporations, governed by American law, must manage corporations primarily for the benefit of shareholders. The effect of this principle is made clear in a famous case, Dodge v. Ford Motor, wherein Henry Ford decided to stop paying dividends “to employ still more men, to spread the benefits of this industrial system to the greatest possible number, [and]to help them build up their lives and their homes.” The court held that the profits of a corporation cannot be withheld from stockholders for the benefit of the general public and that a dividend must be reinstated.

Further Federal Regulation Following the Great Depression:

The abuses of the corporate form, which caused the 1929 stock market crash, led to the passage of the Securities Exchange Act in 1934 under President Franklin Roosevelt. The focus of this legislation was to promote transparency in the market for public securities by requiring disclosure of audited financial records and empowering the Securities and Exchange Commission to enforce compliance with the law’s objectives.

State Regulation of Corporations:

While federal regulation has had a significant impact on corporate law, the bulk of regulation occurs at the state level. State law largely defines the duties of corporate directors, the shareholder voting process, the procedures for amending bylaws and certificates, and other areas central to proper corporate governance.

Status as Individuals for Purposes of Free Speech:

Under the law, the status of corporations as “individuals” has taken on new meaning in recent years. In Citizens United v. FEC, the Supreme Court held in a 5-4 decision that corporations have a political right to free speech under the First Amendment.

Under Citizens United, corporations’ right to free speech includes the right to “use money amassed from the economic marketplace to fund their speech.” In effect, this gives corporations the ability to capitalize on their vast resources to engage in political speech protected under the First Amendment. This decision adds another dimension through which corporations have a great impact on our day-to-day lives.

(in other words... money being "free speech"... using investor monies for political purposes)

Collectively, the events described above deliver three main takeaways:

(1) historically, corporations have had a vast impact on our economic, political, and social relationships – a phenomenon that will likely continue into the future;

(2) corporations have the beneficial capacity to facilitate large-scale, risk-intensive endeavors that would be impossible for individuals or governments to achieve alone, and

(3) the opportunity for abuse of the corporate form may, in appropriate cases, call for government regulation to ensure that corporations serve legislatively-defined societal interests.

Part Three: Corporations and Public Benefit

The shape and evolution of the corporate form through the Colonial Era, the Industrial Revolution, the Great Depression, and Citizens United demonstrate how the government has expanded and limited corporate power to ensure that corporations are working for the benefit of society. This begs the question: where will we be 100 years from now? This is a very important question, especially considering the vast impact that corporations have on our lives.

Some states, including New York, allow companies to incorporate as “benefit corporations” (“B-corps”). In New York, B-corps may be run for a specific public benefit, which may include but is not limited to,

“

(1) providing low-income or underserved individuals or communities with beneficial products or services;

(2) promoting economic opportunity for individuals or communities beyond the creation of jobs in the normal course of business;

(3) preserving the environment;

(4) improving human health;

(5) promoting the arts, sciences or advancement of knowledge;

(6) increasing the flow of capital to entities with a public benefit purpose; and

(7) the accomplishment of any other particular benefit for society or the environment’ (BCL §1702(e)).”

To become a B-corp in New York, a new corporation must define the specific benefit it aims to pursue within its certificate of incorporation. Existing corporations can become B-corps through amendments to their certificates.

The effects of laws like these are significant. B-corps do not have the same duties as other corporations to run the business exclusively for the profit of shareholders, like Henry Ford was compelled to do. Instead, directors of B-corps can actively consider the interests of other stakeholders.

If Ford Motor Co. was defined as a B-corp in 1919, perhaps Henry Ford would have been allowed to provide for his workers and make cars more affordable for the general public, to the possible detriment of other shareholders. There will likely be court cases that decide that question in coming years. Today, well-known companies such as Patagonia, Eileen Fisher, Warby Parker, Method, Seventh Generation, Ben & Jerry’s, and Etsy are already designated as B-corps.

The development of B-corps has coincided with a larger corporate trend of corporate social responsibility (“CSR”), which calls for companies to be held accountable to stakeholders in addition to their traditional duty to shareholders. An apt example of a traditional corporation practicing CSR is Starbucks, which has made efforts to ethically source its coffee, sponsor community service endeavors, and reduce the environmental impact of its products, amongst other stakeholder-oriented initiatives.

B-corps and traditional corporations practicing CSR present many questions that remain unanswered, including:

(1) how will these operate in the era of Citizens United,

(2) will consumers favor these companies over traditional shareholder-oriented companies,

(3) what limitations do B-corps pose on businesses,

(4) what are the legal obligations of B-corps to provide profit for shareholders versus benefits for stakeholders, and

(5) will existing corporations voluntarily convert to B-corps?

The answers to these questions will determine whether B-corps and trends involving CSR will have a significant societal impact in the future. Legislative bodies, at the federal, state, and local levels, will be called upon to resolve these intricate policy issues, with input from all stakeholders.